(This was one of the first Conservative.to articles and is published as it originally was from our archives).

A lot of people have gotten into debt with their banks and spent their whole lives paying it down while living paycheck to paycheck, but also saving into an annuity designed to be dispersed over tens of years. That is a highly in-optimal approach for anyone. The scientific investment formula is to take all of your saving and put them aside as your treasure ears you income, and under no circumstances incurs a shrinking transaction. And the larger it grows, the more income it makes you. You follow those rules and apply them to your life, then take at least 10% of everything you earn and add it onto the treasure, and if you do that, and what you invest your treasure in never loses money, that is the applied scientific investment formula. Adhering to those rules is straight forward enough, but how can you ensure that you never invest in anything that loses money, and what should you be investing into.

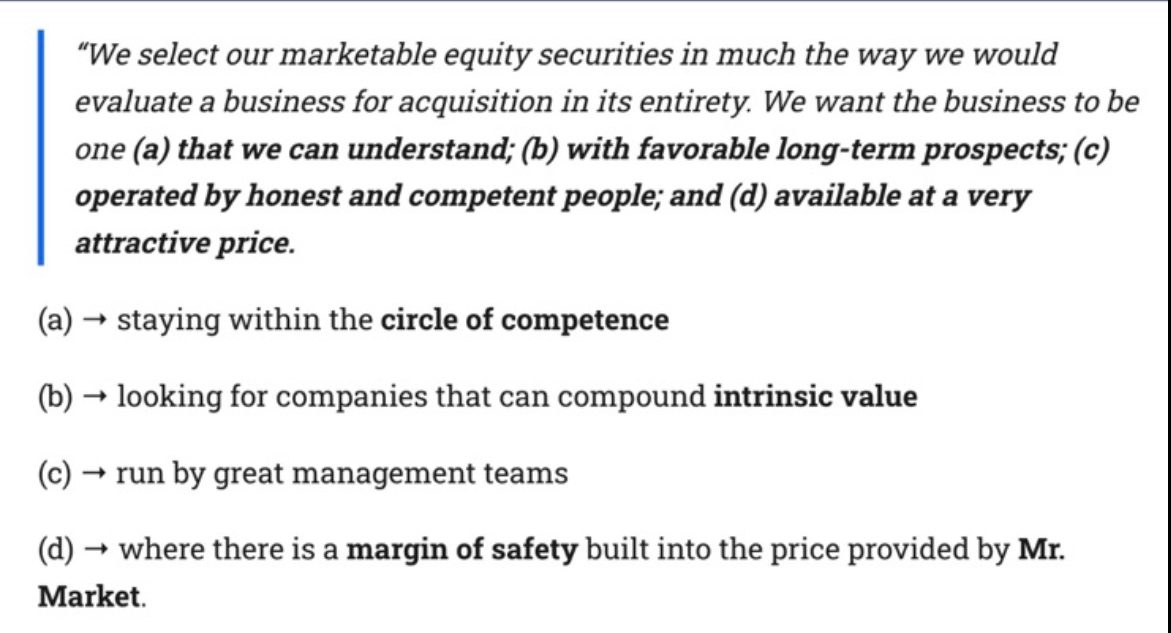

Warren Buffet’s investment criterion statement:

Our methodology:

Warren Buffet’s criterion is indisputably the optimal way to go about investing, but the real question is what mergers and acquisition prospects are the best targets and how can you maximize their value. And so what I say is people should invest their life savings into between one and seven companies that sell products or services that they are happy customers of in their daily lives, and pursue a career working for the one that they either invest the largest portion or all of their portfolio in. Public companies, but preferably small private companies and even smaller startups that you can buy at a much lower valuation and then help grow yourself.